- #Eleventh standard accounts book pdf

- #Eleventh standard accounts book full

- #Eleventh standard accounts book trial

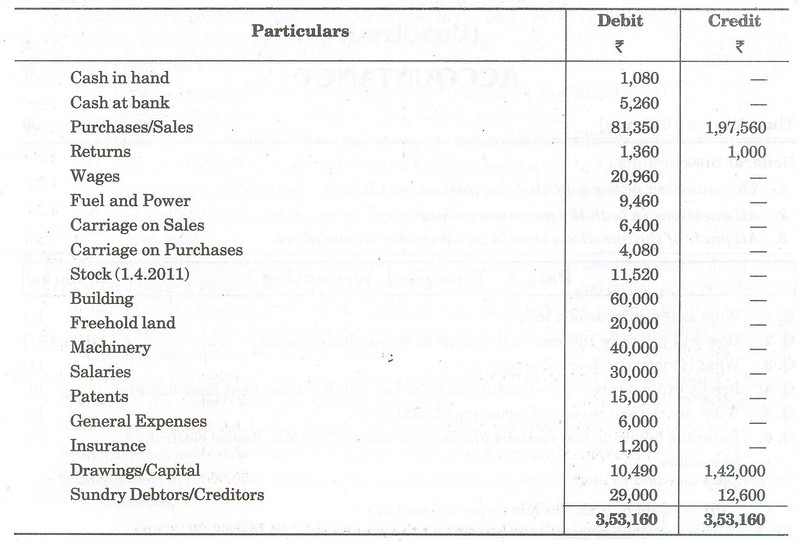

Trial balance: objectives and preparation (Scope: Trial Balance with balance method only).Ledger – format, posting from journal, cash book and other special purpose books, balancing of accounts.Bank reconciliation statement- calculating bank balance at accounting date: need and preparation. Corrected cash book balance.Preparation of Bank Reconciliation Statement, Ledger and Trial Balance Other books: purchases book, sales book, purchases returns book, sales returns book and journal proper.Cash Book: Simple Cash Book, Cash Book with Discount Column and Cash Book with Bank and Discount Columns, Petty Cash Book.Books of original entry: format and recording – Journal.Origin of transactions- source documents (invoice, cash memo, pay in slip, cheque), preparation of vouchers – cash (debit and credit) and non cash (transfer).Rules of debit and credit: for assets, liabilities, capital, revenue and expenses.Accounting equation: analysis of transactions using accounting equation.Accounting Standards and IFRS (International Financial Reporting Standards): Concept and objectives.Bases of Accounting : Cash basis and accrual basis.

#Eleventh standard accounts book full

Accounting Principles: Accounting entity, money measurement, ac-counting period, full disclosure, materiality, prudence, cost concept, matching concepts and dual aspect.Fundamental Accounting Assumptions : Going concern, consis¬tency and accrual.Basic accounting terms: business transaction, account, capital, drawings, liability (Non – current and current) asset (Non – current tangible and intangible assets and current assets), receipts (capital and revenue), expenditure (capital, revenue and deferred), expense, income, profits, gains and losses, purchases, purchases returns, sales, sales returns, stock, trade receivables (debtors and bills receivable), trade payables (creditors and bills payable), goods, cost, vouchers, discount – trade and cash.Accounting: objectives, advantages and limitations, types of accounting information users of accounting information and their needs.Part A: Financial Accounting – I (50 Marks) Financial Statements of Non-profit Organizations Financial Statements of Sole ProprietorshipĤ. Latest Syllabus and Marks Distribution Accountancy Class XI for the academic year 2019 – 2020 Examination.ģ. MP Board Class 11th Accountancy Syllabus and Marking Scheme

Chapter 16 Preparation of Final Accounts of Sole Trade.Chapter 13 Bills of Exchange and Promissory Note.Chapter 8 Bank Reconciliation Statement.Chapter 3 Business Transactions and Double Entry System.Chapter 2 Fundamental Assumptions and Principles of Accounting.MP Board Class 11th Accountancy : Financial Accounting MP Board Class 11th Accountancy Important Questions with Answers Here we have given NCERT Madhya Pradesh Syllabus MP Board Class 11 Accountancy Book Question Bank Solutions Lekhashastra Pdf.

#Eleventh standard accounts book pdf

MP Board Class 11th Accountancy Important Questions with Answers Guide Pdf Free Download लेखाशास्त्र in both Hindi Medium and English Medium are part of MP Board Class 11th Solutions.

0 kommentar(er)

0 kommentar(er)